Funded Nation Risk-Free Funded Accounts for Indian Traders in 2025

Many Indian traders desperately want to have more trading capital without the need to put in large own fund at risk. Even the most skilled and experienced Indian traders often find themselves limited by the amount of capital at their disposal and prop firm funded accounts become their most suitable solution. Indian traders, while preferring to avoid large personal losses, do not mind paying small prop firm challenge fees if it means that they can safely use firm capital through funded accounts.

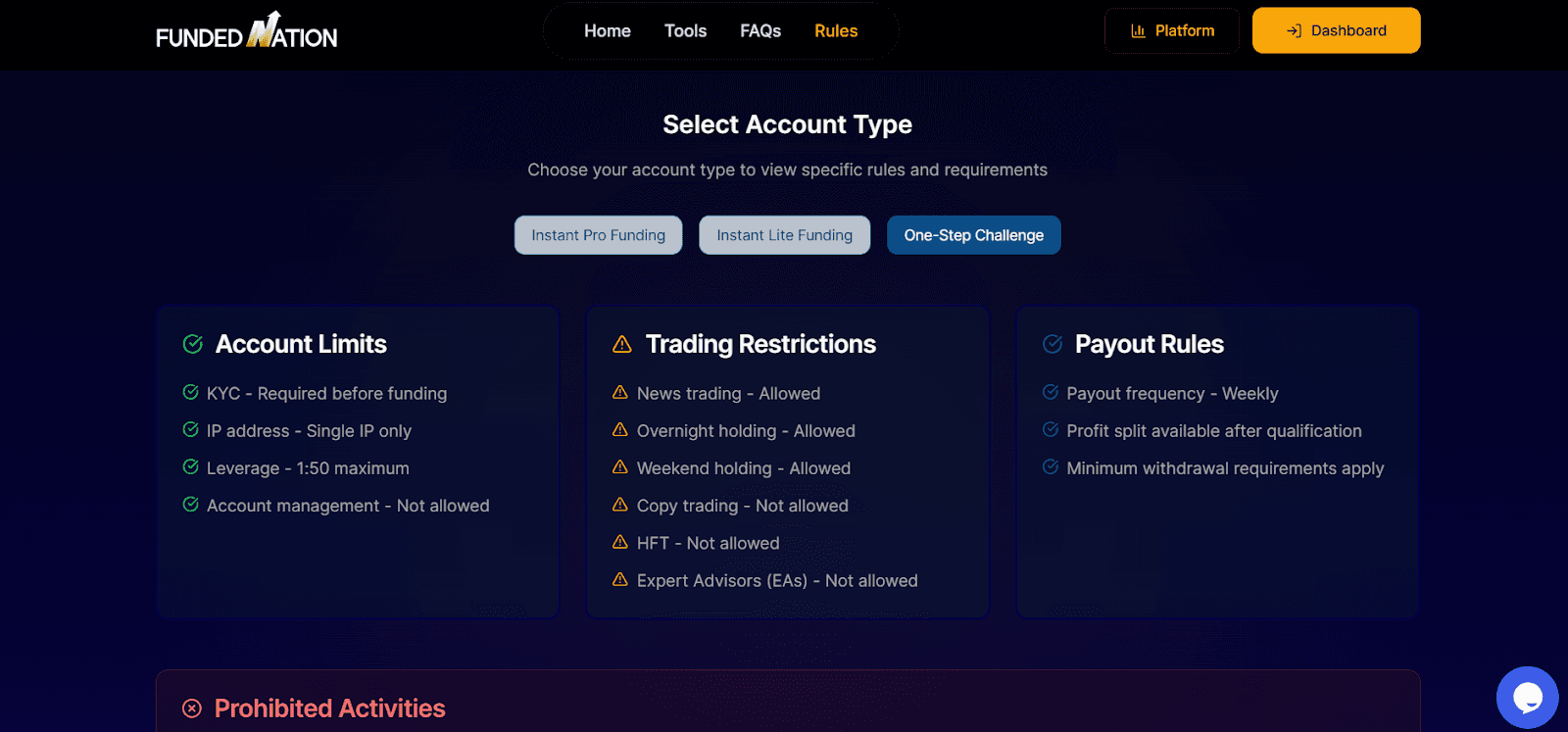

One-Step Challenge, Instant Pro and Instant Lite models by Funded Nation are the three options that target beginner and intermediate traders from India and are all meant to be affordable.

In 2025 Indian traders will still get to choose from the Funded Nation One-Step Challenge, Instant Pro or Instant Lite to enjoy low-risk funded accounts - they can also trade using firm capital in the latter two cases.

Why Indian Traders Prefer Funded Accounts

A large number of Indian traders choose for funded accounts with prop firms since they provide a mode of trading that is less risky and more economical. Personal accounts are not heavily invested. The trader is given access to the firm's fund and is only required to follow a few risk-management rules. In this firm, the strategists are not distracted by the threat of a significant loss. The funded account also offers a higher capital option, relaxed trading conditions and the chance to earn consistent payouts - making it a feasible choice for new traders as well as experienced traders in India.

Is Prop Trading Regulated in India? (SEBI & RBI Explanation)

Prop firm trading is an unregulated market in India. The Securities and Exchange Board of India (SEBI) and the Reserve Bank of India (RBI) are against the activity but do not intervene with imposing any restrictions, the prop trading industry lies in a grey area in this respect. There is no regulatory authority that oversees prop trading in India. This means that Indian traders might do it, but they should be aware of the risks involved.

Prop firm trading is not regulated in India. The Securities and Exchange Board of India (SEBI) and the Reserve Bank of India (RBI) neither permit nor prohibit it, the prop trading industry is in a grey area. There is no regulatory body that tracks prop trading in India. So Indian traders can deal here, but they have to be fully aware of the risks involved.

Let us figure out a prop trading risk-free account types.

What Is a “Risk-Free” Funded Account in Prop Trading?

In a funded trading, the term 'risk-free' denotes that the trader is not accountable for the loss of the trading capital. Funded Nation allows traders to utilize the firm’s capital. It is not in its interests to see traders losing capital. Funded Nation came up with the idea of risk management rules. These regulations reduce the risks for both, the firm and the trader.

Traders gladly pay a small account fee for the use of the firm's capital. The money is kept safe from being lost. The major risk for Indian traders is that of account loss - if the rules are violated, the funded account will be closed. In this case, traders lose the capital and the profit that have been accumulated in the account. If traders are found breaking the risk rules, the account will be terminated and any unrealized profits will be lost.

How Funded Nation Minimizes Trader Risk

Funded Nation provides a low-risk funded account because the traders are given the firm's capital and not their own. Funded Nation provides a risk-free funded account. Those traders who perform well may raise the level of their accounts. The capital is, in fact, risk-free for the Indian trader, but he has to adhere to the Funded Nation Rules of risk management if he wants to keep his account safe.

Steps to Get a Risk-Free Funded Account in 2025

This prop firm is not as difficult as you think. If you follow the steps outlined below, you can identify a risk-free funded account in 2025.

Step 1: Pass the Funded Nation One-Step Challenge

Prop trading, just like any trading, is very risky. Traders initial move will be to pass Funded Nation's One-Step Challenge, which is the way to get a funded account after finishing the profit target and risk rules. To gain access to the firm's capital, traders have to pass the evaluation.

The one-step challenge is a way to get familiar with risk management. Funded Nation makes available a demo account to pass the challenge. For that, you have to practice the rules and figure out ways to lower the risk. Traders have to follow the risk management rules of Funded Nation.

Step 2: Trade Safely Using Simulated Capital

The Funded Nation evaluation is a demo account, so no real capital is at risk except for the challenge fee. Traders are utilizing simulated funds during the evaluation, they are not exposing any real capital, besides the challenge fee, to risk. In this funding model, the trader's own fund is not at risk - only a small challenge fee is paid.

The only risk that they run is the loss of the account fee that is caused by failing the challenge. To activate the challenge account, they need to pay the challenge fee. This is the way Indian traders usually take the first step with the Funded Nation One-Step Challenge.

Step 3: Choose Instant Pro or Instant Lite for Fast Funding

All instant funding accounts involve some trading risk because traders operate with real firm capital. Traders are using the firm’s money to trade on a variety of financial markets. Funded Nation manages trading risk through strict but simple trading rules. That is why they introduced Instant Pro and Lite. Starting with a low-cost $5,000 Instant Pro account helps Indian traders keep financial risk to a minimum while testing their trading strategy. Skilled Indian traders can skip the challenge and opt for the Funded Nation Instant Lite or Instant Pro Account. They can start earning real payouts while keeping personal financial risk close to zero.

The Funded Nation instant accounts like Instant Pro and Lite are in the range of $5,000 to $100,000. They provide scaling alternatives to escalate the account size. A profit split is very advantageous to Indian traders, as they are allowed to keep a considerable part of their profits. Besides, it has lesser trade limitations. It permits holding at night and during the weekend. There is no need for a profit target to be met if a trader wants to ask for a payout in the Funded Nation Instant Pro account.

The table below explains the rules and allowed limits for the 1-Step Challenge.

Funded Nation 1-Step Challenge Rules (2025 Overview)

Let’s compare the Funded Nation’s funded account risks and rules.

Funded Nation Instant Funding Model Comparison (Instant Pro vs Lite)

Is Funded Nation Truly Risk-Free for Indian Traders?

Prop trading in India sits in a grey regulatory zone, so no account can be 100% risk-free. However, Funded Nation reduces risk of finance for Indian traders by offering capital-backed accounts, simple rules and no personal capital exposure. When traders follow the risk-management rules, the chances of losing money drop significantly - making it one of the safest options in the Indian prop ecosystem.

Why Funded Nation’s Instant Pro Is a Lower-Risk Option

The Instant Pro account is considered lower risk for Indian traders because:

- No personal funds are at stake - traders only pay an activation fee.

- No profit targets - this removes pressure and reduces the chances of account violations.

- Lower drawdown requirements (3% daily, 6% max) - easier to manage.

- Flexible trading conditions - overnight holding, news trading and weekend trading allowed.

- Immediate access to firm capital - traders skip evaluation and start trading right away.

This combo makes Instant Pro one of the safest practical choices for traders who are searching for quick and low-risk funded access in India.

Why Skilled Indian Traders Prefer Instant Funded Accounts

Experienced Indian traders choose instant funding because:

- They don't want to waste time on multi-stage evaluation types.

- They want scaling opportunities to grow from ₹4 lakh to ₹80 lakh+ funded capital.

- High profit splits (up to 80%) maximize earnings.

- Indian traders avoid the emotional pressure, which meeting strict profit targets.

Instant accounts offer a good and smooth trading experience, especially for traders who understand risk management and want a fast and real fund.

Conclusion - Should Indian Traders Choose Funded Nation?

Funded Nation keeps its risk management rules simple and easier for Indian traders to comply with them as they scale gradually. Their personal financial risks are lowered as the traders are given a firm capital to trade with. Funded Nation transfers the largest part of the income to its traders. This is the main reason why Instant Pro accounts are the most attractive low-risk options for traders in India. Along with a high profit split and on-demand payouts, the account can be a successful tool for traders.

Traders are free to use whatever strategies they have tested and increase the profit share to the maximum. There are fewer limitations, straightforward rules and no profit target in Instant Pro - which makes it one of the lowest risk instant funded accounts available for Indian traders.

Log in to the Funded Nation Dashboard and explore its risk-free funded accounts.

Frequently Asked Questions

Get answers to common questions about our prop trading program and evaluation process.