Best Funded Accounts for Indian Traders 2025 – Full Comparison Guide

Every trader is looking for the best-funded accounts in 2025. Indian traders are not far behind. We first need to determine which account is the best-funded. Every prop firm is trying to satisfy the traders’ demand for the best prop firm. But we cannot say who is shooting in the dark, the prop firms or the traders. There is a marked gap between what traders expect and what prop firms offer. Let us close this gap once and for all.

In this blog, we will understand the best-funded account from a trader's and prop firm’s perspective and help you zero in on the best funded accounts you can get in 2025.

How Prop Firm Accounts Help You Trade Forex and F&O

Trading equity derivatives (F&O) and Forex trading requires large capital. You need time to create capital for such trades. Skilled Indian traders want to specialize in price action, indicators, or algorithmic strategies. They need large capital. Trading large capital can come under the scanner.

Indian traders are looking for global platforms. Prop firms with large capital can provide that. Trading forex, indices, commodities and crypto is easy on global prop trading platforms. With prop firms, they do not have to use personal funds. Funded Nation is a prop trading firm with a worldwide reach. Now, they are gaining ground in India. They offer instant funding and large capital at a low cost. They allow trading in forex, crypto, commodities and indices. Funded Nation's one-step challenge offers traders instant funding accounts. The highlights are large capital, fewer rules and on-demand payouts. Funded Nation helps a scalper, day trader, swing trader, or EA/bots/algo traders to find the right account.

What Is a Funded Trading Account?

A funded trading account of a prop firm provides its own capital to traders. Traders to use the platform within the risk management rules and generate profit. Traders get the payout of profit share between 80% and 90%.

How prop trading works:

- Select direct funding or undergo a challenge (evaluation stage)

- The entry to both the challenge and the funded account has a fee.

- You need to select the account size ranging from $5,000 to $100,000.

- Based on the account size, the fee is decided

- Fees are nominal compared to the capital you need for trading.

- Traders can trade within the daily and maximum drawdown rules, trade global instruments and meet profit targets while following trade strategy restrictions.

- You generate profits. And get a share of it.

Why do Indian Traders Choose Prop Firms for Trading?

- They can use the firm’s fund instead of risking their own

- They can save the ₹3–5 lakh margin money for F&O

- Indian traders feel restricted and want a global platform

- Assets like forex, Gold, Oil and Crypto are not easy to trade in India

- Low cost per capita, much safer to lose than personal capital

- Easily scalable accounts with large amounts: $100k, $200k, $1M accounts

How to Choose the Right Funded Account Type

Funded accounts match capital with trading requirements for Indian traders with a capital crunch.

- A scalper needs fast execution and tight spreads. Instant funding allows both.

- A swing trader needs overnight holding or weekend holdings. One-step challenge allows both.

Benefits of Trading with Funded Nation Accounts

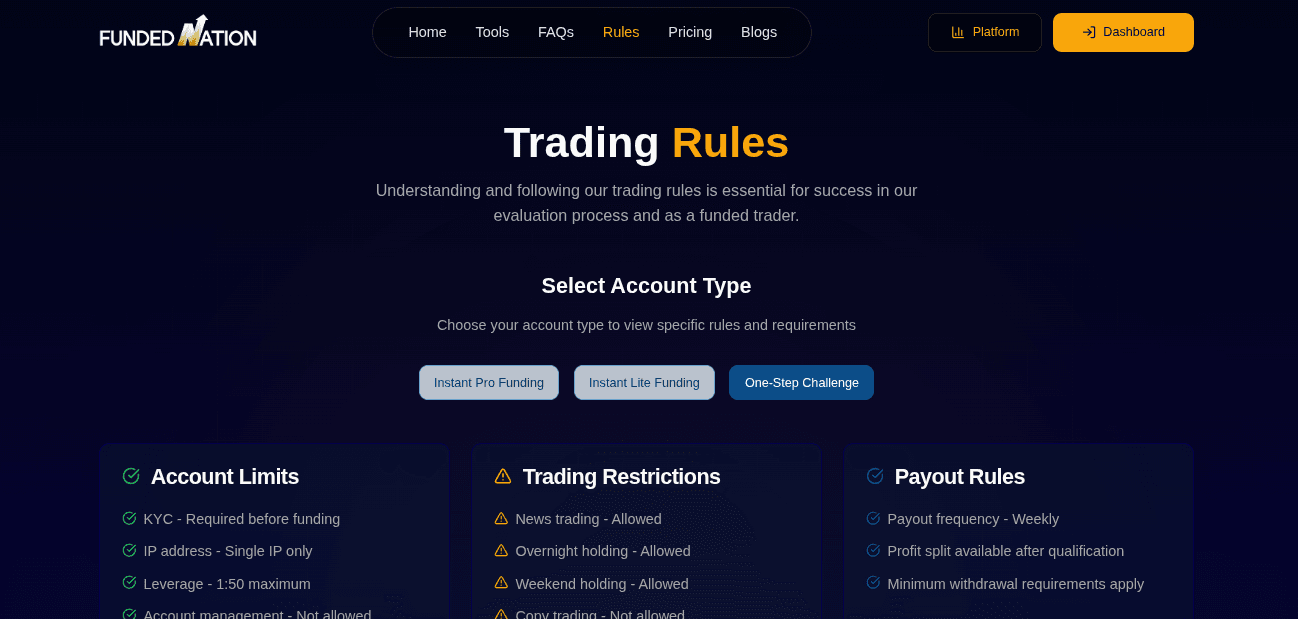

Funded Nation offers multiple funded account types matching specific styles of trader.

1. Benefits of Instant Pro

- For aggressive traders

- Large trading capital instantly.

- Higher starting balance at a lower cost.

- Suitable for intraday traders and scalpers.

- No evaluation, no waiting

2. Benefits of Instant Lite

- For moderate risk traders

- Start slow and small with a low-cost instant funding model.

- Ideal for risk-averse traders who want to start cautiously.

- Less stressful, requires smaller initial capital

- No evaluation, no waiting

3. One-Step Evaluation

- Help avoid lengthy evaluations

- Single phase, easy to pass, quick to get funded

- Flexible and easy rules for beginners.

- Ideal for swing, position and EA traders

Quick Comparison of Trading Style vs Instant Accounts

Match Trading Style with Account Type

Trading Style - Scalper

Scalpers execute multiple trades a day. They aim for small but quick, consistent profits.

What helps them achieve their goals:

- They want tight spreads for quick but consistent gains

- They want low latency for speedy execution

- Freedom for rapid entries and exits because they believe in high speed due to low margins

- They do not want to get tied to a high daily drawdown, because they take risks, trade and earn profit multiple times

Ideal Account Type based on Trading Style - Instant Pro

Scalpers need back-tested strategies. They want to execute trades quickly, at high speed, with no latency. For them, a low-cost, instant model matters. Scalpers also benefit from immediate access to funded accounts. They do not need the challenge phases.

Trading Style - Day Traders

They use structured intraday setups, strategies like breakouts, “Mean” reversals, supply-demand, ICT patterns, etc.

Day Traders prefer:

- Transparent rules and risk managment

- Easy drawdowns that they can maintain

- Dependable Execution without errors

- They do not require overnight holding

Ideal Account Type based on Trading Style - Instant Pro

Instant Pro offers flexibility, fewer rules, large scalable capital, moderate drawdown, with execution speed and stability. Day traders look for consistency. Once they attain consistent results, they do not disturb this trading structure or scale faster.

Trading Style - Swing Traders

Swing traders prefer overnight or weekend holdings that can span 2 to 5 days.

Swing Traders need:

- To benefit from holding a trade overnight or over the weekend

- Allow a bigger stop-loss to accommodate a longer wait

- Larger daily and maximum drawdowns for high-risk and high-gain

- They need low stress and do not want to succumb to pressure

Ideal Account Type based on Trading Style: 1-Step Evaluation

One-step challenge allows the flexibility to experiment with strategies. It has clearer rules suitable for trades over multiple days.

Trading Style - EA/Algo Traders

Traders using EAs or algorithms need:

- Dependable server connections

- No or fewer slippages

- Precise risk parameters

- Platforms supporting trading with EA and favourable rules

Ideal Account Type based on Trading Style - Instant Pro or 1-Step Challenge

Instant Pro and a one-step challenge may allow EA with approval. Both may allow algorithmic or automated trading setups with approval and tight risk management constraints. You can also use Instant Lite. We recommend Instant Pro and One-Step for bot-friendly risk management rules.

Beginners Trading Style

Beginners prefer:

- Low-risk platform

- Low cost and spreads

- Transparent, simple rules to follow

- No or low-stress environment

Ideal Account Type based on Trading Style - Instant Lite/One-step Challenge

Beginners can start the One-step challenge cautiously with a small account size and capital. They can start small and go slow. They can test strategies. Learn from mistakes and step back. It offers low fees and no pressure. It requires the trader to meet a profit target. They can scale as they gain experience and become confident about their strategies by switching to Instant Pro.

Funded Nation Rules of Risk Management for Traders

Before getting a funded account at Funded Nation, Indian traders should learn about the critical risk parameters of the firm as mentioned below:

1. Daily and Overall Drawdown Rules

There are two types of Funded Nation Drawdown limits: daily drawdown and overall drawdown. It can be trailing and static.

- Drawdown is critical to your risk profile.

- Daily drawdown - Traders must maintain a daily drawdown of 3% to 4% of the initial account balance to avoid account closure.

- Total drawdown - Traders must never exceed the overall drawdown, ranging from 6% to 8% of the account balance.

- Learn about the drawdown types - Trailing and static and you can maintain them when applicable.

2. Meet Profit Targets based on account types

The Funded Nation profit targets vary between the funding account types Indian traders select. Not all Funded Nation accounts necessarily have profit targets.

- Profit targets help maintain realistic goals

- It helps traders maintain psychological stability.

- For Funded Nation, Instant Pro and Instant Lite have no profit targets. The one-step challenge has a profit target of 8%.

3. Allowed Trading Instruments

Trading instruments vary between prop firms. Indian traders must check if the prop firm allows trading of their specific instrument.

The most common instruments are:

- Forex pairs

- Commodites

- Cryptocurrencies

- Indices (US30, NAS100)

4. Funded Nation Payouts for Indian Traders

Indian traders also must check the Funded Nation withdrawal and payout methods. While most prop firms allow withdrawal via cryptos, not many support bank transfers. Check which Funded Nation payout method is available for Indian traders.

Most common payout modes include:

- Payment apps like Wise

- International payment transfers to a PayPal account

- Universal payment transfer in Cryptos

- Country-specific Bank transfer (if conversion allowed to INR)

5. Funded Nation Trading Conditions

Trading conditions affect trade execution and book profits. Trading conditions help Indian traders to trade within the risk management constraints.

The factors that can affect the trading conditions for Indian traders include:

- Prop firm Spreads

- Slippages in trade expectations

- Execution speed depends upon your trading style

- Platform technology and ease of use: MT4, MT5, cTrader, TradinView

Why Funded Nation Is a Strong Choice for Indian Traders

Funded Nation has gained popularity among Indian traders due to:

Safe payout modes for Indian traders

Funded Nation pauouyts are easy and hassle-free. Traders can withdraw payouts via crypto and bank transfers.

Advanced server technology prevents Low-latency.

Funded Nation supports high execution speed and multiple trades for scalpers and those who want to use EA/bots/algorithms.

Industry best profit split up to 90%

Traders can enjoy the maximum benefits of their hard work. On Funded Nation, traders are eligible for a maximum profit share of up to 90% depending on the account type.

Strong Indian trader community

Many Indian Telegram and Discord groups discuss Funded Nation’s rules, payouts and strategies.

Grow with the trader community.

Funded Nation has a large trader community focused on Indian traders. Community groups on social media and Discord can help traders with knowledge of Funded Nation’s rules, payouts and strategies.

Transparent drawdown rules

Easy to maintain daily and maximum drawdowns for one-step challenge, instant Pro and Instant Lite funded accounts. The rules are favourable to both intraday and swing traders.

Low-cost account sizes

Indian traders can start prop trading with small capital. They can start with low-cost challenges and funded accounts. Funded Nation account costs are tailored for Indian Traders who are looking to start with low initial costs.

Clear rules to support trading strategies

Funded Nation has clear rules for traders' strategies that can match their trading styles. Funded Nation allows news trading, overnight and weekend holdings, use of algorithms and EAs with approvals. These transparent, trader-friendly rules help Indian traders avoid rule violations. Indian traders across India are choosing Funded Nation prop trading because of strong trust factors.

Real-World Trader Strategy Use Cases

Let's have a sneak peek at a few use cases and how you can select your account based on your trading style.

Use case 1: Scalper using BankNifty

Rahul, an Indian Trader, wants to trade on BankNifty and uses scalping logic, which he learned from other scalpers. For scalping, he needs fast entries and quick exits. So, Rahul chose the Funded Nation Instant Lite for himself because:

- It has a low entry cost and no profit targets.

- Traders can start with a small account size.

- It gives immediate access to a funded account.

- A trader can use the time to build tested profitable setups in actual market conditions.

- Learn from the scalper community to stay consistent.

Use case 2: Swing trader using the EUR/USD currency pair

Sharon is an Indian trader. She trades in higher timeframes, around 4 hours Daily.

She selects the Funded Nation One-Step Evaluation because:

- Allows overnight holding

- Allows wider stop-loss levels

- It has a better risk balance

- Has enough time to test strategies

Use case 3: Aggressive traders.

Rohit is an experienced and skilled Indian Trader. He is looking for high-risk, high-profit. He also wants a low-pressure trading environment. Funded Nation recommends starting with Instant Pro.

Rohit benefits from:

- Has Fewer rules

- No pressure, no profit target

- Affordable, low cost for initial account size

- No limitation, no consistency needed

In summary:

- Scalpers, who need high execution speed) Or intraday traders can opt for Instant Lite. It provides instant, low-cost access to a funded account with higher capital, fewer rules and lower drawdown risk.

- Aggressive and disciplined day traders need high capital. They can opt for Instant Pro with larger account sizes, scalability, fewer rules and quick access to big funds.

- Swing traders who want to hold positions overnight or over the weekend can opt for the One-Step challenge. It provides flexibility with proper risk managment. You can enjoy better scaling to larger funded accounts once you have proven your consistency and performance.

Conclusion

Global prop firms will be accessible to the majority of Indian traders in 2025. Indian traders must carefully choose the prop firm platform, account type and size according to their trading style. The account size, cost, strategy and risk parameters are critical to continue prop trading. Be careful before paying for a challenge or instant-funded account. Prop trading is profitable for Indian traders. They can access global instruments, scale their strategies and protect personal financial loss. Funded Nation Prop trading is for scalpers, swing traders, EA traders, or beginners. It offers funded accounts to every Indian trader in 2025.

Explore Instant Pro, Instant Lite, or the One-Step Evaluation on Funded Nation.

Frequently Asked Questions

Get answers to common questions about our prop trading program and evaluation process.