How to Avoid Prop Firm Breaches: Proven Tips to Stay Funded

Have you ever lost a prop firm account? We hope you have not. But you can always prevent total account loss due to prop firm breaches. Let us share proven tips to stay funded with prop firms for a long term.

But, first, a few words on prop firm breaches - they are critical for traders to continue trading on the Funded Nation platform or any other prop firm you have enrolled with. There are primarily two types of breaches, hard breaches and soft breaches. After reviewing the account, if a soft breach is found, the trader may get a notification or suspension. A hard breach can result in a total loss or account blowout. Funded Nation helps traders prevent prop firm breaches with easy risk management rules.

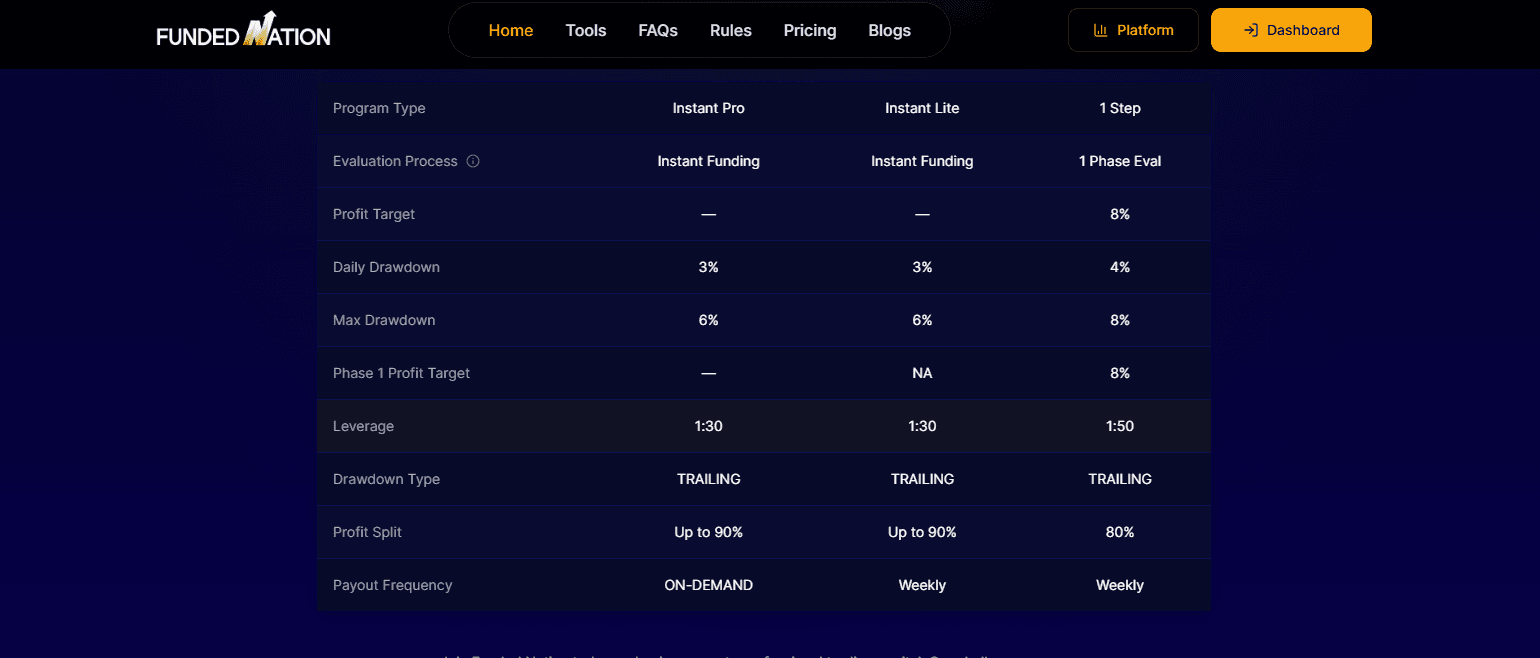

In prop trading, there is always a risk of losing a prop trading account. Even experienced traders may face these conditions. An account loss is a total loss, including account fees, accrued profits, and any account balance. If it happens, you need to start all over again by paying the account fee upfront. That is why we recommend that instead of starting a funded account, such as Instant Pro and Instant Lite, you can get started with Funded Nation's one-step challenge. A one-step challenge helps you master risk management rules and test your strategies.

Let us learn more about the reasons for prop firm breaches and how proper risk management can prevent account blowouts and stay funded.

Prevent Prop Firm Breaches with Funded Nation Rules

Most accounts blow out at the challenge level when you are young and naive on the platform. It catches you unaware. But there is always a way out. But let us discuss below the mistakes the traders may commit.

Have you read the Pro Firm Risk Management rules?

Have you understood all the risk management parameters before joining the prop firm? Read the terms and conditions and FAQs as well. If you have not, you run a high risk of blowout. Learn and understand every parameter, however small or insignificant it may appear, and learn how to calculate it.

Are you too confident about your Prop Firm skills?

If yes, you may overlook or miss out critical fine lines in the risk management clauses and rules. Knowledge helps you to stay funded and continue prop trading for the long term. Even experienced traders need to learn the rules. When you know the rules and risk management parameters, you can start trading confidently

Have you built profitable prop firm setups and prop trading strategies?

Most traders do not work on setups and strategies. They keep it for a later stage, and by the time it is too late. They are more excited to earn a profit. A trading strategy and setup are the key to success in prop trading. You can secure your account by following the rules and preventing account blowout. To stay funded for the long term, create a planning document that clearly stipulates your financial goal, critical risk management rules and targets, strategies, and setups.

Are you chasing prop firm profits and not controlling your emotions?

Always plan a profitable setup plan. Aim for consistency and not high gains. Focus on the process and not profits. Chasing losses due to revenge trading can be a trading mistake. It increases the chance of total blowout from a single blow. Desperation to achieve or result in moving into uncharted trades, making a series of losses, and trading on unfavorable price points. All these increase risks and reduce sustainability. The key is to start small and grow steadily.

Can you adapt to the changing prop firm market conditions quickly?

You must know how to keep up with the evolving market conditions. Markets are always highly volatile. The markets are dynamic due to price fluctuations. The markets may be affected by high-impact news, events, mergers and acquisitions, trends, cycles, and sentiments. Be flexible and build new strategies and unique trading techniques.

Are you using the appropriate prop firm strategy for the market?

The prop trading market allows you to trade in forex, crypto, indices, and commodities. Check the suitability of your strategy in the market. A trend-following strategy works only in a trending market. If you apply it in a range market, it might fail. Similarly, for scalpers, a scalping strategy may be good for a volatile market but may not work in a stable, non-dynamic market. A right strategy in the right market can save your account.

Are you willing to learn from past prop trading mistakes?

It is normal to make errors. Committing mistakes in prop trading is not a point of no return, but learn from your mistakes and not repeating them is. Journaling can help you identify the errors and avoid making the same mistakes. Understanding mistakes can prevent violating the risk management constraints, the key to staying funded. Learn from your weaknesses and capitalize on your strengths. The faster you realize, the faster you correct them and save your account.

Do you maintain a prop firm trade journal?

Introspection in trading is essential. Learn from each day’s achievements and errors. Maintaining a journal instills discipline, accountability, and focus, which are the qualities of a great prop trader. Journaling is not only writing about what has happened, your strategies, exit and entry points, price, losses, and gains, but also your thoughts, emotions, psychology, and mental stability. Track your performance and progress each day, identify patterns and trends.

Do you maintain Work Life Balance in prop trading?

Taking breaks from trading refreshes and rejuvenates the mind and brain. It gives you the impetus to start with renewed enthusiasm. It is healthy to take breaks between trading days and start with a fresh mind. It provides time to learn and prepare with new updates. Constantly engaging in trading can cause stress and burnout, and you may make mistakes. It can result in an account loss due to small errors you can easily avoid. Ensure you spend quality time with your family, friends, or yourself.

Do you know when to avoid trading?

Not only do you avoid trade when the market conditions are not favorable, or you are expecting a change or news update. You should also avoid trading when you are not in a good state of mind due to family, personal, social reasons, or not well both physically or mentally. It is very common to see people impose trading on themselves even though they do not want to, just because of the fear of missing out (FOMO).

Have you joined a good mentorship program?

Are you taking trading knowledge and insights from the trader community? Prop firm help desk, community, and mentorship are good places where you can gain knowledge and learn new strategies. Funded Nation Discord is one such help desk where traders discuss their trading experiences. It is a place where queries are resolved, insights, news, updates, and discount information are shared. What you learn may come as a surprise. A mentorship program can share valuable insights, learnings, and skills to succeed in prop firm trading. You can even learn from the mistakes of fellow traders.

Conclusion

Prop trading is demanding evaluations. It has no room for mistakes or unpreparedness. It hates undisciplined traders. Identifying the errors and implementing the backtested strategies can save your account. Avoiding the mistakes outlined here will increase your success rate in prop trading. Focus, discipline, continuous learning, and adherence to risk management constraints help avoid account closure.

Learn how you can easily pass the low-cost one-step challenge on Funded Nation and get funded quickly without hassles.

Frequently Asked Questions

Get answers to common questions about our prop trading program and evaluation process.